All Categories

Featured

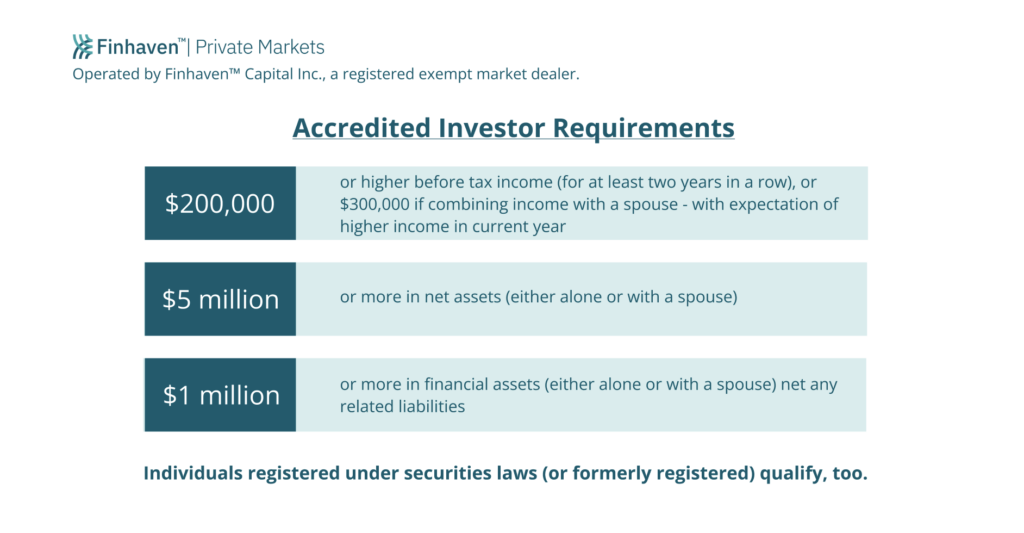

A financial investment car, such as a fund, would certainly need to establish that you qualify as an approved capitalist - am i an accredited investor. To do this, they would certainly ask you to complete a set of questions and perhaps provide certain files, such as financial statements, credit scores reports. private placement accredited investors, or income tax return. The benefits of being an approved capitalist include access to unique financial investment opportunities not available to non-accredited capitalists, high returns, and increased diversity in your portfolio.

In specific regions, non-accredited financiers also have the right to rescission (accredited investors leads). What this suggests is that if a capitalist determines they want to take out their cash early, they can declare they were a non-accredited investor the entire time and receive their money back. It's never ever a good concept to supply falsified files, such as fake tax returns or monetary statements to an investment lorry simply to spend, and this might bring legal trouble for you down the line (qualified purchaser definition sec).

That being claimed, each deal or each fund might have its very own constraints and caps on financial investment amounts that they will approve from a financier. Recognized financiers are those that satisfy particular needs relating to revenue, certifications, or web worth.

Latest Posts

Tax Lien Certificate Investing

Real Estate Tax Lien Investing

What Does Tax Lien Investing Mean